How to submit?

$ev_name

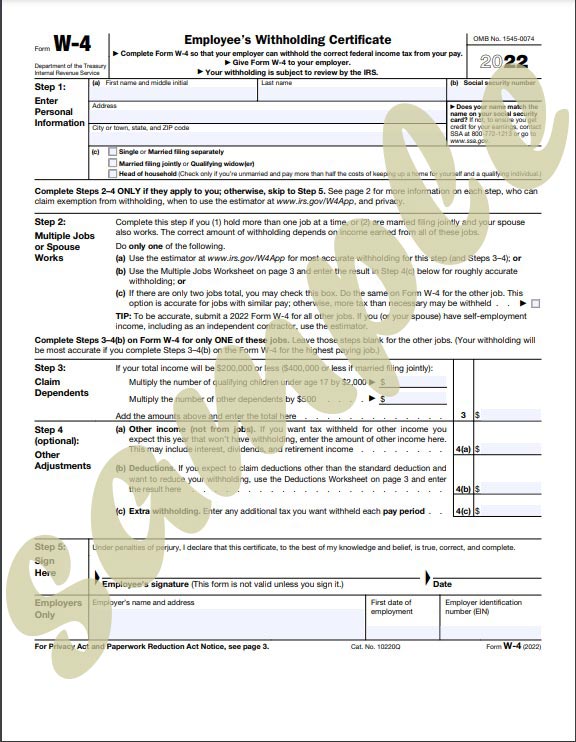

$ev_name allows the host to withhold the correct amount of federal income tax from the pay. If an exchange visitor is paid a salary or wage, they would have to complete Form W-4 at the program start.

At the beginning of the program

Complete the following steps at the program start. Upon receipt of the actual SSN, upload a copy of the filled form or click the lock icon above upload button #$ev_id to acknowledge completion of the process.

Step 1 Download Form W-4 (participant)

Step 2 Present the filled form to the host (participant)

Step 3 Withhold taxes from the paystub as per Form W-4 (host)

Upon receipt of the SSN number

Participants who have yet received their SSN may enter “Applied For” (paper) or “0” or the “control number” from the appointment confirmation letter as per

instructions from SSA. If the payroll website requires a real number to be entered, use the paper forms for the time being. After receiving the SSC, if the quarterly wage report has been filed, correct the records using

Form W-2C.

Step 4 Submit the SSN to the host upon receipt of the SSC (participant)

Step 5 Update Form W-4 with the actual SSN (host)

Step 6 Upload a filled form or click the lock icon above upload button #$ev_id (participant)