Resources > Orientation

BridgeUSA (EVP)

The BridgeUSA (J-1 Visa) Exchange Visitor Program (EVP) offers non-immigrant visas to foreign nationals for cultural and educational programs in the United States.

Last modified on Apr 26, 2023

Returnwww.fusia.net/bridgeusa

Established in 1961, the EVP aims to promote mutual understanding between Americans and people from other countries through educational and cultural exchanges. It also strengthens international ties, fosters global awareness, and promotes friendly and peaceful relationships between the United States and other nations.

Other names. The Exchange Visitor Program (EVP), also referred to as “BridgeUSA” and “J-1 visa,” is a cultural exchange program governed by 22 CFR Part 62 and administered by the Bureau of Educational and Cultural Affairs (ECA) within the US Department of State.

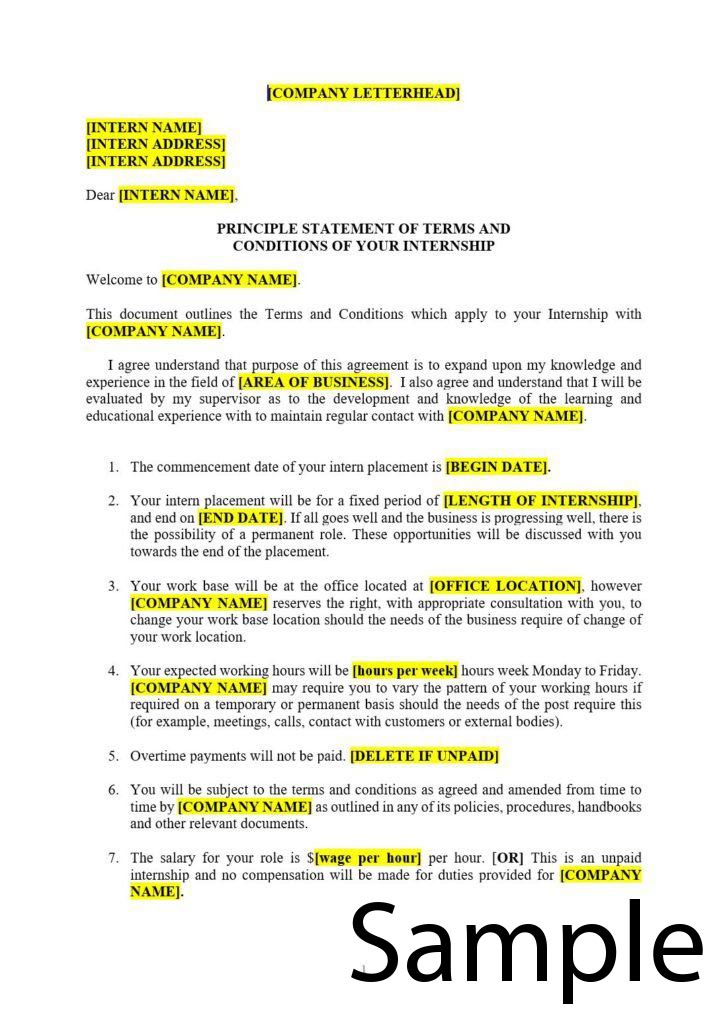

General knowledge. The program includes 15 categories, such as internships, trainee programs, university and college programs, summer work and travel, au pair programs, and more. It collaborates with 1,500 sponsors from academic, government, private, and non-profit sectors across the United States.

Statistics. Today, the EVP provides educational and cultural exchange opportunities to around 300,000 visitors from 200 countries and territories who come to the United States each year.

To download the welcome brochure and learn more about the EVP, click HERE. Click HERE to download the pamphlet on work-based exchange visitor rights.

Other names. The Exchange Visitor Program (EVP), also referred to as “BridgeUSA” and “J-1 visa,” is a cultural exchange program governed by 22 CFR Part 62 and administered by the Bureau of Educational and Cultural Affairs (ECA) within the US Department of State.

General knowledge. The program includes 15 categories, such as internships, trainee programs, university and college programs, summer work and travel, au pair programs, and more. It collaborates with 1,500 sponsors from academic, government, private, and non-profit sectors across the United States.

Statistics. Today, the EVP provides educational and cultural exchange opportunities to around 300,000 visitors from 200 countries and territories who come to the United States each year.

To download the welcome brochure and learn more about the EVP, click HERE. Click HERE to download the pamphlet on work-based exchange visitor rights.