How to submit?

$ev_name

Opening bank accounts

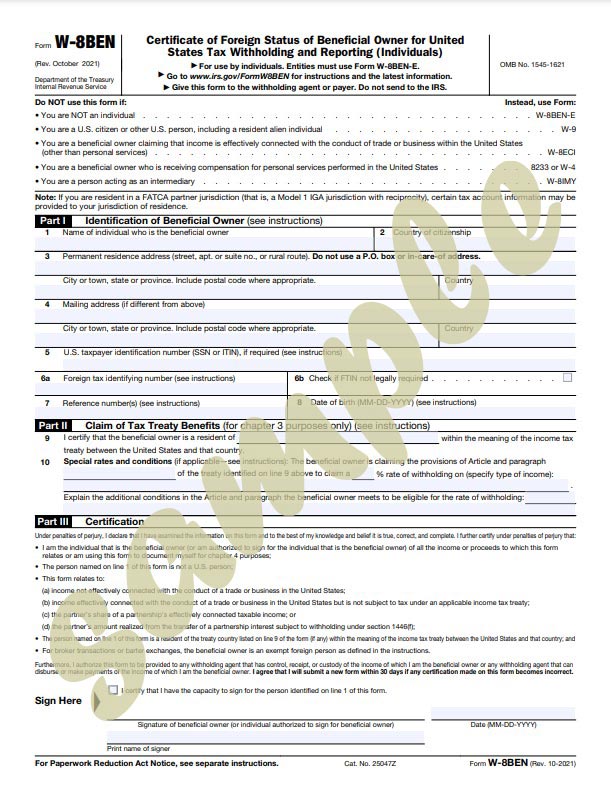

NRA individuals that may be subject to 30% withholding of US federal taxes on US-source income need to fill out Form W-8BEN before they receive their first payment, even if they can claim an exemption from withholding.

Step 1 Complete the form when opening bank accounts

Stpe 2 Submit it to the bank when opening bank accounts

Step 3 Upload a filled form or click the lock icon above upload button #$ev_id (participant)

Not opening bank accounts

If eligible yet not claiming or if not eligible to claim such benefits, click the lock icon to acknowledge completion of the process.

Step 1 Click the lock icon above upload button #$ev_id (participant)

What to note?

1 For interest, dividends, rents, etc., NRAs are taxed at 30%.

2 This tax is imposed on the gross amount paid and is generally collected by withholding.

3 Do not send $ev_name to the IRS or file it with a tax return.

4 Remain valid for at least three calendar years