Key Points

1

SSC is a paper card with a 9-digit

SSN issued by

SSA for reporting wages to US government.

2 EVs earning income in the US need to apply for a

SSC.

3

SSC may also be required for credit check (e.g., applying for a credit card/postpaid phone plan).

4 Unpaid EVs who receive non-wage income, such as stipends, may apply for an

ITIN instead.

5 Securely store your

SSC. Once compromised, resolving

SSN fraud can be very difficult.

How It Works?

Required Documents

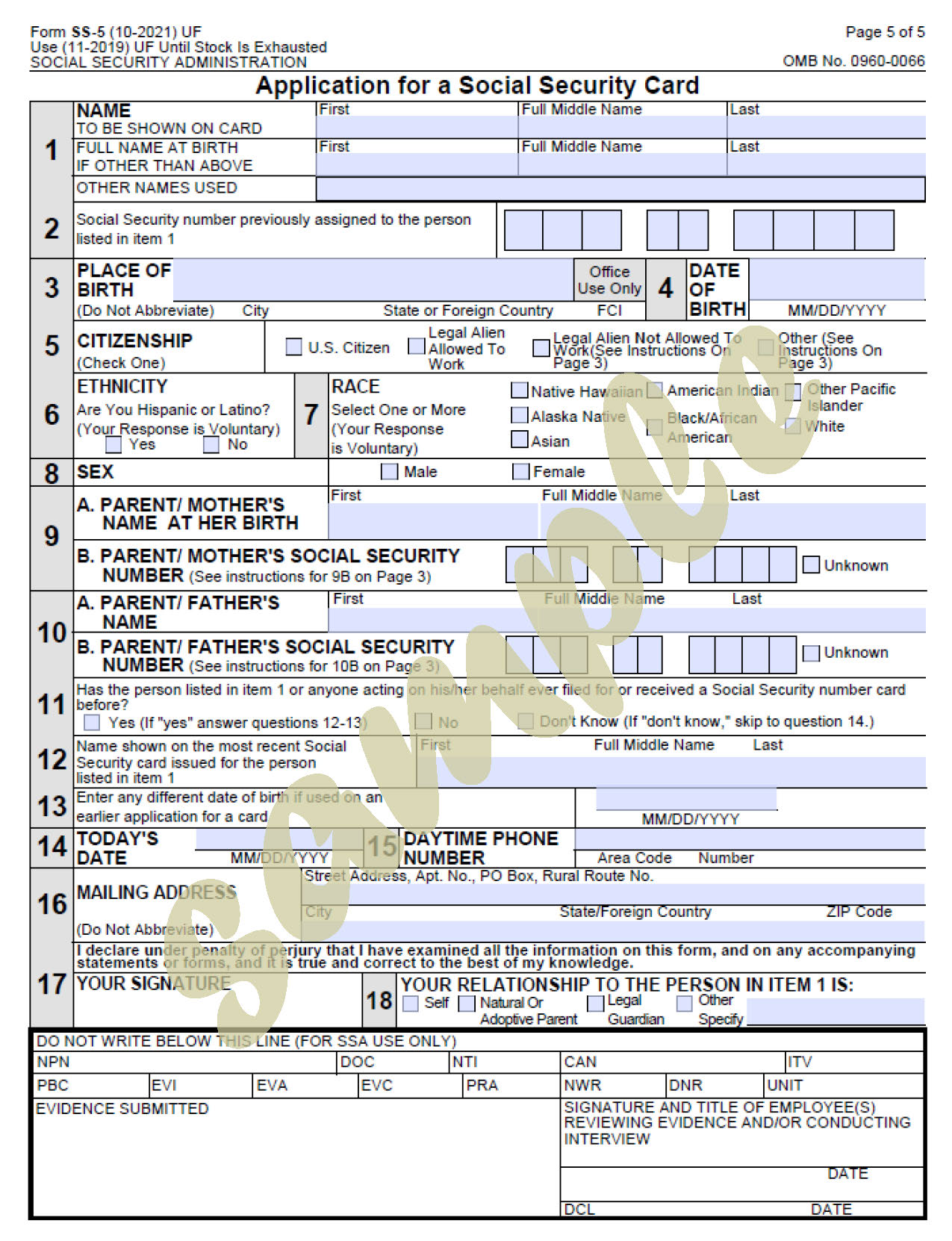

1 Application:

SS5

2 Admission Docs: #2 passport | #39 Most Recent

I-94

3 SEVIS Docs: #22 DS-2019 | #23 DS-7002

4 Support Letters: From FUSIA (page 3 in ) | #43 Offer letter from Host

What to Note?

1 Ensure that your address can safely receive mail. If mail delivery is not secure, consult the office for personal pickup.

2 If walking in, with or without an appointment, aim for the first appointment slot to avoid long lines.

3 The provided list of required documents is usually less comprehensive. Bring more documents to avoid another trip.

4 Click

HERE for more information from

DHS and

HERE about SSN fraud.

5 After receiving your

SSC, present it to HR, amend

I-9 &

W-4 with your

SSN, and upload acknowledgment letter as #97.

6 Ensure your record is in

SAVE before applying. If not,

SSA typically waits 10+ days for a second attempt. If the record is still not found, it will be sent to

DHS for verification, which is complicated and hard to follow up on.