Resources > --

--

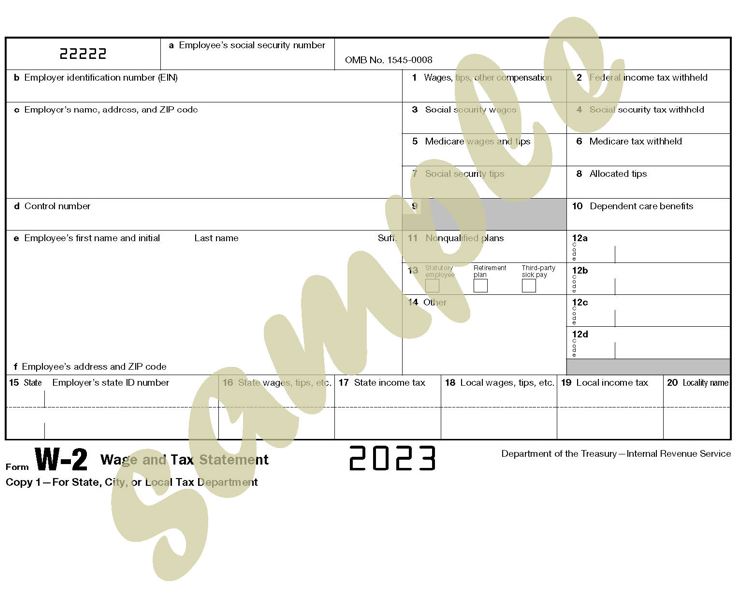

Form W-2, Wage and Tax Statement, is completed by the host and for the host to report wage, salary, and other compensation paid to employees to the IRS – the host should provide each paid participant a copy for them to file it along with Form 1040-NR to the IRS. This document consists of populated data. Generate the PDF via the participant’s online panel to show individualized information.

Returnwww.fusia.net/w2